Gold Price Crash

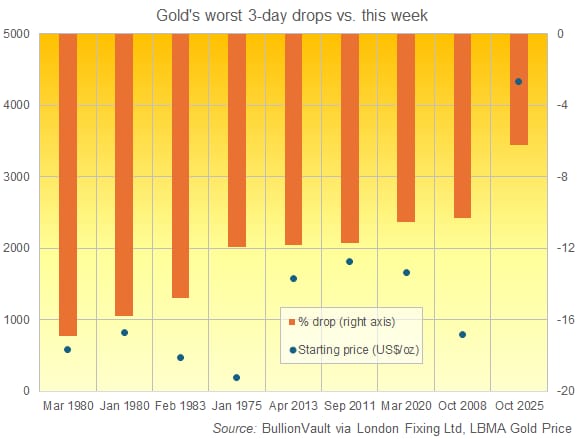

Global precious‑metals markets experienced a sharp drop Tuesday . As gold prices plunged by more than 5 % after touching record highs the previous day. The dramatic fall followed a wave of profit‑taking among investors and raised concerns over market volatility.

Analysts noted that gold had been buoyed by economic‑uncertainty premiums and low real interest rates—but with recent signals of stabilising interest rates and stronger economic data coming from major economies, some investors pulled back, triggering the drop. The slide in gold was mirrored by a 7 % plunge in silver prices.

The sell‑off illustrates how quickly sentiment can shift in asset markets: metals may act as safe‑havens, but even these markets are not immune to liquidity‑driven reversals. For economies reliant on commodity‑linked investments, the turbulence adds another layer of risk. Analysts warn that if real yields continue upward, gold may struggle to regain momentum in the near term.

Why it matters

Gold is often considered a hedge against inflation and economic uncertainty; a sharp drop signals that investors may be shifting back toward risk assets or expecting stronger economic outcomes (less need for “safe” gold).

For countries and companies holding gold reserves, the drop can impact balance sheets or investment valuations.

In emerging‑markets currencies and economies that hold significant precious‑metals exposure, there may be indirect impacts via inflation expectations, currency valuations or capital flows.

The move may prompt re‑assessment among ETF holders, central banks and mining‑companies as to where safe‑haven demand stands heading into 2026.

What Next

Mining companies and investors should examine their hedging strategies: if a strong gold rally is no longer assured, what are alternatives?

Emerging‑market financial regulators should monitor currency and commodity exposures tied to precious‑metal price swings.

The Urban Gazette shall look at how the drop in gold affects East African mining, Kenya/Uganda/South Africa metal exports, or regional currency flows.