Bank of Uganda calls for Bold Financial Reforms at Development Summit

Reporter Kizindo Lule

Wakiso-Uganda

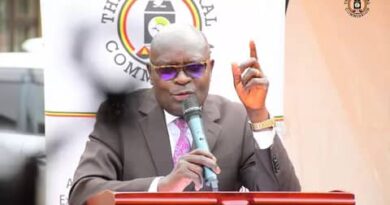

The Governor of the Bank of U ganda, Dr. Michael Atingi-Ego, has called for bold reforms in Africa’s development finance systems, urging national development banks to become engines of inclusive and sustainable growth.

Speaking at the closure of the two-day Uganda Development Finance Summit at Speke Resort Munyonyo, Dr. Atingi-Ego emphasized that Africa stands at a defining moment, with vast potential in population, natural resources, and innovation.

Atingi-Ego stressed the need for development banks to bridge funding gaps, lower interest rates, and reach women, youth, and small businesses.

Atingi-Ego noted that “Financial inclusion is not just policy, it’s a growth strategy.”

The summit, hosted by the Uganda Development Bank (UDB), brought together leaders from across Africa to re-think how development finance can unlock the continent’s full potential.

In a powerful and visionary closing address, Dr. Atingi-Ego urged national development banks (NDBs) to become key drivers of inclusive, sustainable transformation.

Organized by UDB, the summit convened national development banks, African governments, multilateral institutions, and private sector stakeholders to address the urgent financing challenges and opportunities facing the continent.

“This summit has not just been a meeting — it has been a blueprint for a shared future,” Atingi-Ego declared. “We’ve discussed innovative financing mechanisms, explored success stories from across Africa, and made one thing clear: development finance must be purposeful, inclusive, and forward-looking.”

Framed around the theme “Transforming Africa Through National Development Finance Architecture”, the summit emphasized that Africa is at a turning point. With its population expected to reach 2.5 billion by 2050 and with vast natural and digital resources, Dr. Atingi-Ego stressed that Africa has the potential to lead global growth in the 21st century, that’s only if it overcomes financing barriers in infrastructure, climate resilience, and industrialization.

“Our challenges, climate change, infrastructure gaps, persistent poverty, are real, but our opportunities far outweigh them,” he said. “We must unlock the promise of the blue economy, renewable energy, and digital transformation.”

The Governor called on national development banks to reimagine their mandates, aligning closely with national development plans while maintaining a clear focus: correcting market failures, catalyzing private investment, and de-risking long-term projects that traditional lenders avoid.

“Development banks are not meant to distort markets but to fill the gaps commercial banks cannot. We must stop forcing commercial banks to fund long-term projects with short-term liabilities. That model is unsustainable and costly.”

He argued that commercial banks, built around short-term funding models, are ill-equipped to support infrastructure and industrialization since interest rates remain high across many African countries.

Bringing the conversation home, Atingi-Ego unveiled Uganda’s “10X Growth Strategy”, an ambitious plan to grow the country’s GDP from $61 billion in 2025 to $500 billion by 2040. He emphasized that this goal will require over $80 billion in private sector credit — far beyond the current $7.5 billion lent by commercial banks.

“This is more than a goal — it’s a mission to transform lives across our nation. But to achieve it, we need long-term capital, not just working capital.”

He called for urgent capital market reforms, including the introduction of green bonds, infrastructure bonds, diaspora bonds, and Sukuk bonds, while also highlighting the importance of pension sector reforms to unlock domestic long-term finanance.

Central in his message was the need to build a sustainably certified financial sector — one that is ESG-compliant, attracts cheaper capital, and effectively reaches the “last mile,” especially women, youth, and small enterprises.

“We must stop talking only about big factories and focus on those at the bottom of the pyramid. Financial inclusion is not just social policy — it is a growth strategy.”

He emphasized the need to measure value creation in every loan, ensuring that financing directly contributes to job creation, value addition, export development, and poverty reduction.

Quoting economist Prof. Jeffrey Sachs, Dr. Atingi-Ego said Africa — like China before it — can achieve transformative growth with smart investments and bold reforms. He called on global financiers to stop viewing Africa through outdated lenses.

“We must advocate for a global financial system that reflects Africa’s realities and potential.That means reforming credit ratings and tailoring financial systems to support African-led solutions.”

Words to Action

The Governor closed his address with a call to action, urging delegates to carry the summit’s momentum into concrete policies and programs.

“Our success will not be judged by our eloquence, but by the boldness of our actions. Let us direct finance where it matters most — agro-industrialization, renewable energy, and digital innovation — and ensure no one is left behind.”

As the summit concluded, it became clear that a new financial paradigm is emerging — one grounded in purpose, inclusivity, and bold ambition. And at its heart is a vision of Africa not as a continent in need, but one ready to lead.

Voices from the Summit

Dr. Patricia Ojangole, Managing Director, Uganda Development Bank (UDB)

“At UDB, building solutions that address our local development challenges is central to our mandate. We carefully identify the best interventions and ensure that every step we take is by solid research, which we have fully integrated into our work.

Beyond financial sustainability, we are equally committed to demonstrating socio-economic impact. We strive to balance financial soundness with tangible development outcomes, and we consistently demonstrate this balance to our shareholders.”

Institutions must be run professionally and transparently. When we engage partners, they want to know about our governance structures, how we are managed, and whether they can trust the people leading the institution.

Capitalization and the right type of funding are essential. But what truly matters is the quality of resources that can be generated. For national development banks to create real impact, scaling up is critical. Governments must support them by providing capital directed at the right interventions. If governments don’t finance national development banks, someone else will — and that funding will inevitably serve their own agenda, not the country’s.”

Jeremiah Dan-Okayi, Head of Strategy, Policy & Innovation, Development Bank of Nigeria (DBN)

“One of the main reasons SMEs don’t scale is lack of access to capital. Our job is to ensure we help them fulfill their potential by catalyzing access to financing. In Nigeria, only about 10% of capital is channeled to SMEs.

A big reason commercial banks weren’t lending to SMEs was that they didn’t understand the space. When we started about eight years ago, we put five banks through an 18-month program to teach them how to understand SMEs.”